Numbers '09 offered a Checkbook Register in it's Templates Chooser. The same template evolved into the Personal Budget template in later versions.

Here are some reconstuction notes on the '09 template.

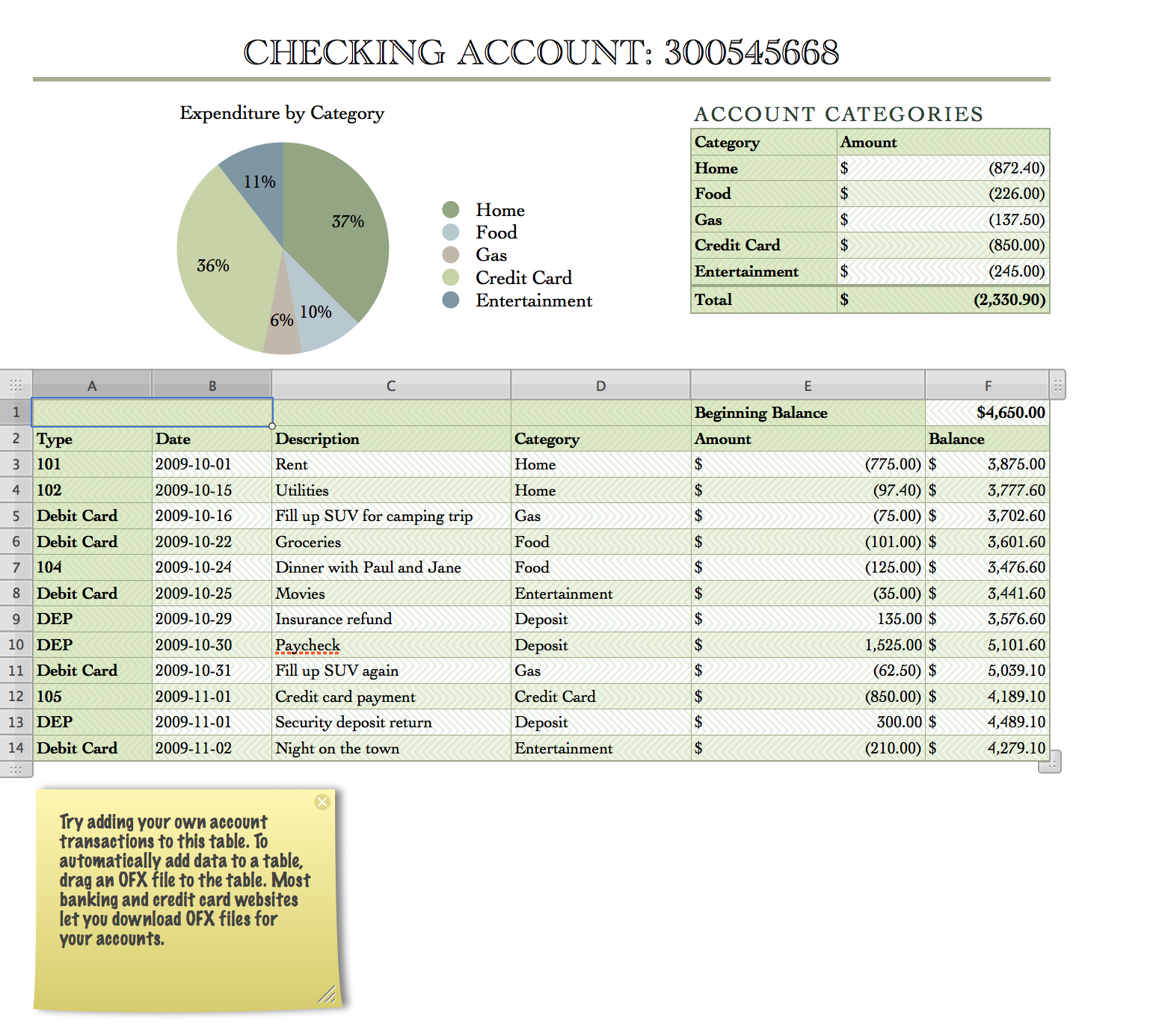

The original template had two tables, The larger one is a register of checks and other spending from a checking account.

The original template had two tables, The larger one is a register of checks and other spending from a checking account.

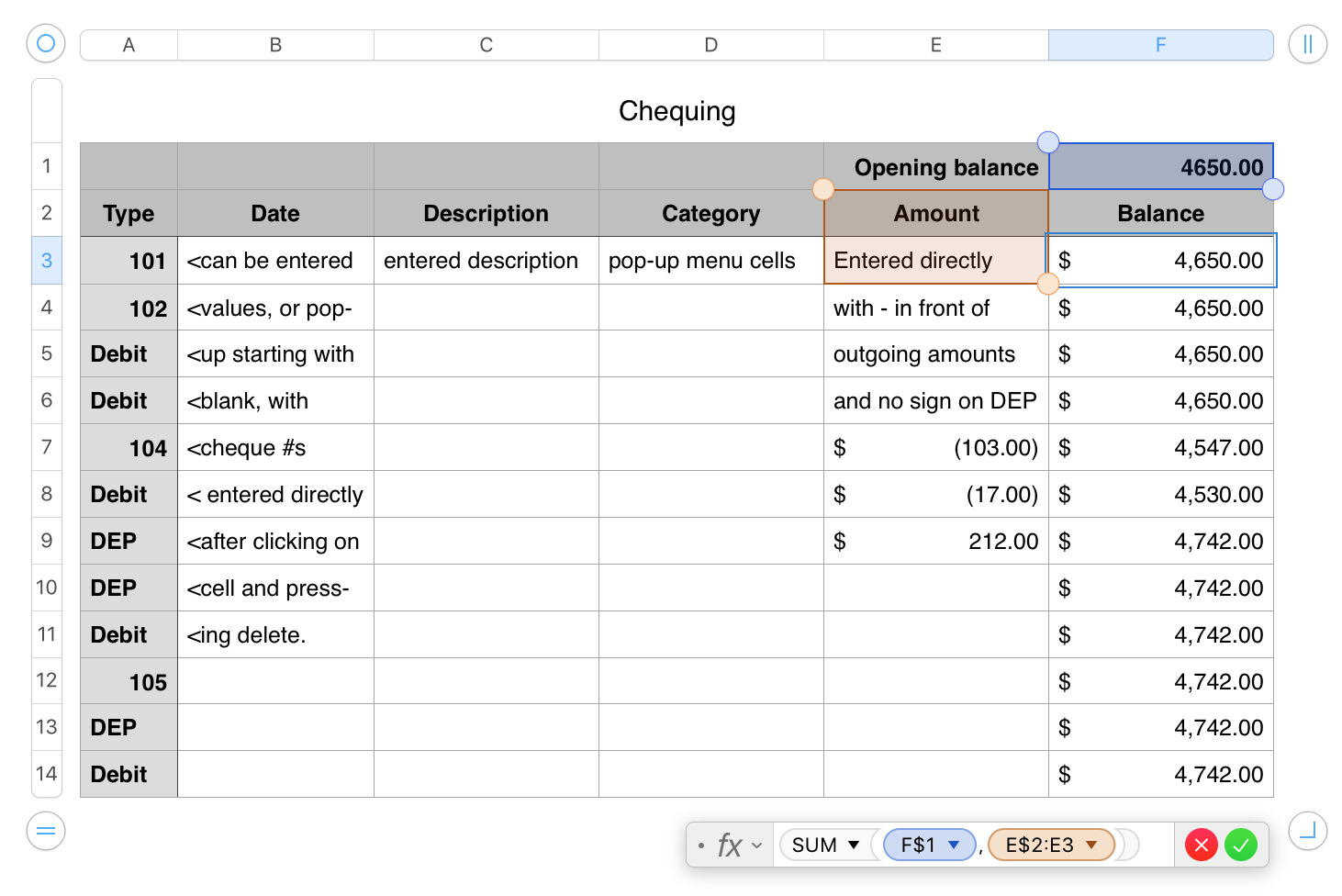

Here's an image of my revised Register table, with notes on the contents of each column.

The table has two Header Rows. Data entry, other than the opening balance amunt in F1, begins in row 3.

All data on the table, with the exception of the values in column F are entered values, entered either directly from the keyboard or chosen from a pop-up menu in the cell. Notes on the table diagram tell what type of data is entered in each column, nd what entry method is used.

Notes in column B refer to the entry methods for the payment method of each transaction. Number entries are always payment by cheque, and, as these are different for every cheque, must be typed into the cell after deleting the pop-up menu from that cell (following the steps noted in column B).

The content of column B is the date for each transaction. The all-number format used in the '09 version is not mandatory. It is useful, though, to choose a single format and use it consistently.

Column C is for a brief description for each transaction.—where did the money go, or where did the money come from.

Column D is used to list the category of each expenditure. A pop-up menu is used here for consistency.

One shortcoming in the original was the classification of "Credit Card" as an expense category, which it is not. Most card transactions are payments for items in one or more of the categories listed. The only payments that fit into Credit Card as a category are the annual fee on a 'premium' card, and interest chargees incurred when carrying an amount beyond the payment due date. Credit card purchases do not come out of the chequing account on the day the purchase is made, but are gathered into a group, billed to the card holder on the billing date, and paid in full or in part by the due date, at which point, those funds come out of the account and the account balance is changed, and the amounts of the original purchases should be added to the amounts being tracked in the individual categories.

That could be done using another table to record and categorize CC purchases, then report the individual amounts to the Summary table, and the total amount of the CC payment recorded as an uncategorized expense (not picked up by the categories listed on the summary table).

Meanwhile, until someone devises a method of doing that winnowing and filtering of credit card purchases and payments, you may want to record those payments as being in the "Credit card" 'category', and live with the misleading pie chart, that in Apple's '09 example cost about the same amoount as the "Home" category.

Column E is to contain the amount of each recorded transaction, starting in cell E3. Because all amounts are entered in the same column, it's necessary to include the - sign at the beginning of expense values, and no sign at te beginning of DEPosit values.

Column F contains the opening balance in the account, entered into cell F1, and the formula shown below the table, entered, as displayed, in cell F3, then filled down to the end of column F.

(The balance in this column does not change until F7, the first row in which a number has been entered in column E. The text values above that row are seen by SUM as zeros.)

When entering amounts, do not include the currency sign. This is added by the Currency format of the cells.

The smaller table, "Account Categories," contains a list of the categories in column A, and a SUMIF formula in column B to sum the expenditures in each category. It contains one formula, entered in B2, and filled down to the last row containing a category name in column A.

B2: SUMIF(Chequing::D,A2,Chequing::F)

Apologies for the lengthy post. Further questions welcomed as needed.

Regards,

Barry